Retirees are often drawn to a tempting idea: since equities typically deliver higher returns over the long run, a retirement portfolio with more equities will produce better outcomes. Wouldn’t it be nice to escape the meagre 3% withdrawal rate by investing more heavily in equities? Unfortunately, it’s not so straightforward.

Beyond a point, increasing equity allocation will reduce, not raise, the withdrawal rate. This is due to a crucial but underappreciated concept: sequence of return risk. In portfolios that experience regular withdrawals, not just the returns but the order in which they are earned matter, which can have dramatic consequences.

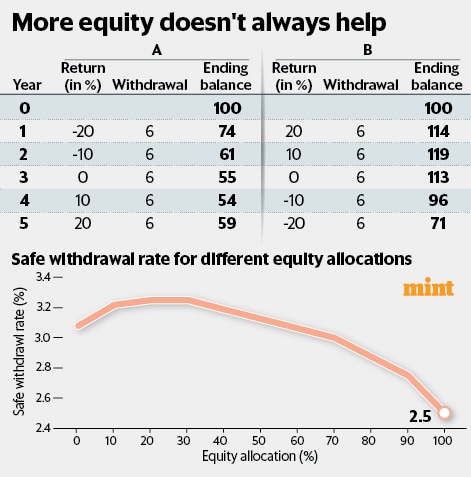

The table shows how two retirees (A and B) experience the same average returns but in different sequences. Despite identical withdrawals, A (who faces early losses) ends up with just ₹59, while B (who sees early gains) ends up with ₹71—this is sequence risk at work.

In a portfolio with no withdrawals, only returns matter—not the order in which they occur. This is because multiplication is commutative: 1 × 1.1 × 0.9 × 1.2 is the same as 1 × 0.9 × 1.2 × 1.1. But when you introduce regular withdrawals, you are now subtracting from the portfolio every year. In mathematical terms, you are combining subtraction with multiplication, and the commutative property breaks down. The arithmetic changes and the sequence begin to matter.

View Full Image

High sequence risk

A retirement portfolio with heavy equity exposure is likely to face substantial volatility and heightened sequence risk. In the accumulation phase, volatility can be a friend—it brings down average cost through disciplined investing. But in the decumulation phase, volatility becomes a foe. A 20% drawdown early in retirement can cause lasting damage, especially if the retiree is simultaneously withdrawing funds to meet expenses. Unlike a young investor, the retiree cannot “wait it out”.

This can be illustrated by conducting simulations on retirement portfolios with varying equity allocation. We conducted multiple such simulations to check how the optimal withdrawal rates vary for different asset allocations.

The findings are unambiguous. Withdrawal rates initially rise with greater equity exposure, peaking at 20–40%, but then begin to fall. Portfolios with higher equity allocation produced meaningfully lower safe withdrawal rates.

This is not a quirk of Indian market data or a one-off observation. William Bengen, the American financial planner who introduced the “4% rule” in 1994, found the same. In his landmark study of historical US data, Bengen was surprised to find that safe withdrawal rates declined when equity allocations increased. He even noted that the worst outcomes were not produced by conservative portfolios with low equity exposure but by aggressive portfolios with too much equity.

This insight wasn’t isolated. The Trinity Study, an influential academic analysis, came to similar conclusions when it tested various asset allocations and their impact on withdrawal rates using US market history. Closer to home, my 2024 co-authored study with Rajan Raju had a similar conclusion. Using Indian data, we found that withdrawal rates initially rise with equity allocation but then begin to decline beyond a certain point.

Though equities offer higher long-term returns, more equity does not always mean more retirement income. This is a paradox we need to wrap our heads around. Retirees should construct a portfolio with a balanced allocation that reduces volatility. If you have been smirking at retirees with good fixed-income allocations in their retirement portfolio, well, the joke may be on you.

Ravi Saraogi, CFA, Sebi-registered investment adviser. and co-founder, Samasthiti Advisors.